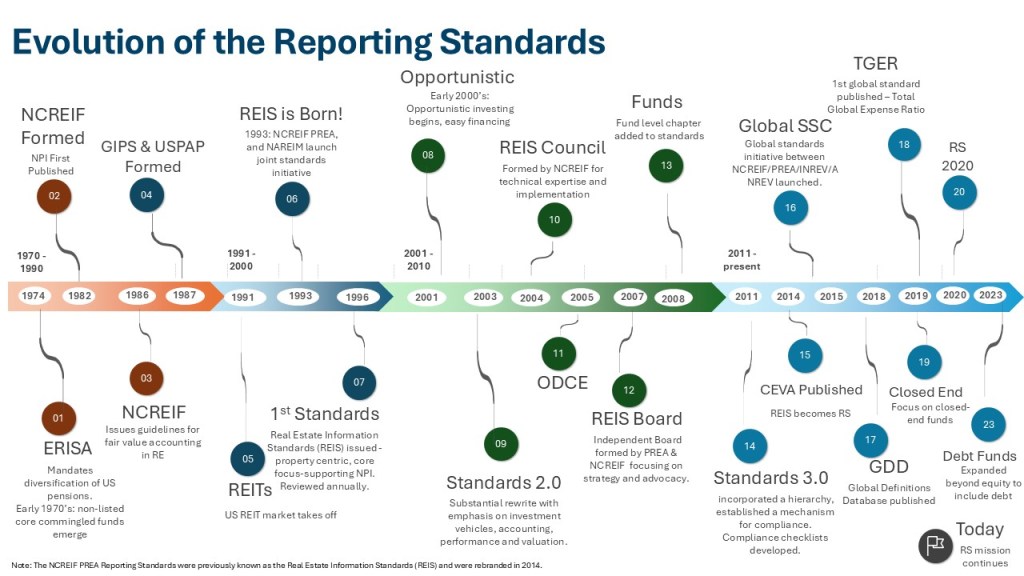

About the NCREIF PREA Reporting Standards

The NCREIF PREA Reporting Standards are a collaborative industry initiative co-sponsored by the National Council of Real Estate Investment Fiduciaries (NCREIF) and the Pension Real Estate Association (PREA). Their mission is to establish, manage and enhance transparent and consistent reporting standards for the real estate industry, fostering comparability and informed investment decision-making.

Why the Reporting Standards Matter

While established standard-setting bodies like the Financial Accounting Standards Board (FASB) and the CFA Institute (creators of the Global Investment Performance Standards – GIPS®) provide broad financial reporting frameworks, they do not fully address the unique needs of institutional real estate investment reporting. The Reporting Standards were developed to fill this critical gap.

Scope and Applicability

The Reporting Standards apply to periodic investor reporting for both commingled funds and separately managed accounts. While many standards are shared across fund structures, some requirements and recommendations are specific to each type.

- Compliance is assessed at the fund or account level, not at the firm level.

- To support compliance, detailed checklists are available.

- To claim compliance, all required elements must be reported. Recommended elements represent best practice and may be applicable in certain circumstances.

Key Benefits

- Supports better decision-making with standardized data

- Promotes industry-wide consistency in reporting

- Enhances investor confidence through transparency